Understanding NYC’s Tax Rates for Purchases

Navigating the tax landscape in New York City can be a bit daunting, especially if you’re new to the area or planning a visit. With its bustling economy and diverse range of goods and services, understanding how sales tax works in NYC is crucial for both residents and visitors. This guide will break down the essentials of NYC’s tax rates for purchases, helping you make informed decisions and avoid any surprises at the checkout.

Sales Tax Basics in NYC

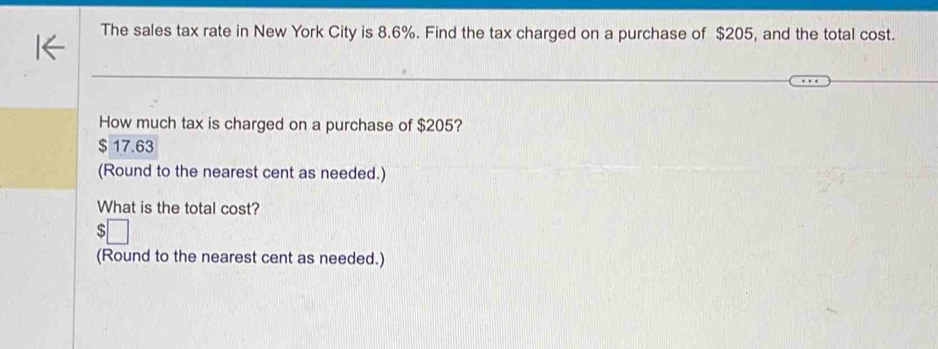

In New York City, the sales tax is a combination of state and local taxes. The total sales tax rate is 8.875%, which includes a 4% New York State sales tax, a 4.5% New York City sales tax, and a 0.375% Metropolitan Commuter Transportation District (MCTD) surcharge. This tax applies to most goods and services purchased within the city. However, there are some exceptions and nuances to be aware of.

For instance, clothing and footwear items priced under $110 are exempt from the 4% state sales tax, though the city and MCTD taxes still apply. This means you’ll pay a reduced rate of 4.5% on these items. Understanding these exemptions can help you save money, especially if you’re shopping for apparel.

Tax on Specific Goods and Services

While the general sales tax rate applies to most purchases, certain goods and services have specific tax rules. For example, prepared food and beverages, such as those purchased at restaurants or cafes, are subject to the full 8.875% sales tax. However, groceries and unprepared food items are generally exempt from sales tax, making it more affordable to shop for everyday essentials.

Additionally, services like haircuts, gym memberships, and certain entertainment events are also taxed at the standard rate. However, some services, such as medical and educational services, are exempt from sales tax. It’s important to check the specific tax rules for the services you use regularly to understand how they might affect your budget.

Tips for Managing Sales Tax in NYC

To effectively manage your expenses in NYC, it’s helpful to keep a few strategies in mind. First, always check your receipts to ensure the correct tax rate has been applied. Mistakes can happen, and being vigilant can save you money. If you’re a business owner, understanding the tax rules is crucial for compliance and avoiding penalties.

For those who frequently shop for clothing, timing your purchases around sales or taking advantage of the under-$110 exemption can lead to significant savings. Additionally, consider using apps or online tools that calculate sales tax for you, making it easier to budget for your purchases.

Lastly, if you’re visiting NYC, be aware that sales tax is not refundable for tourists. Plan your shopping accordingly and factor in the tax when budgeting for your trip.