Understanding Overdraft Fees

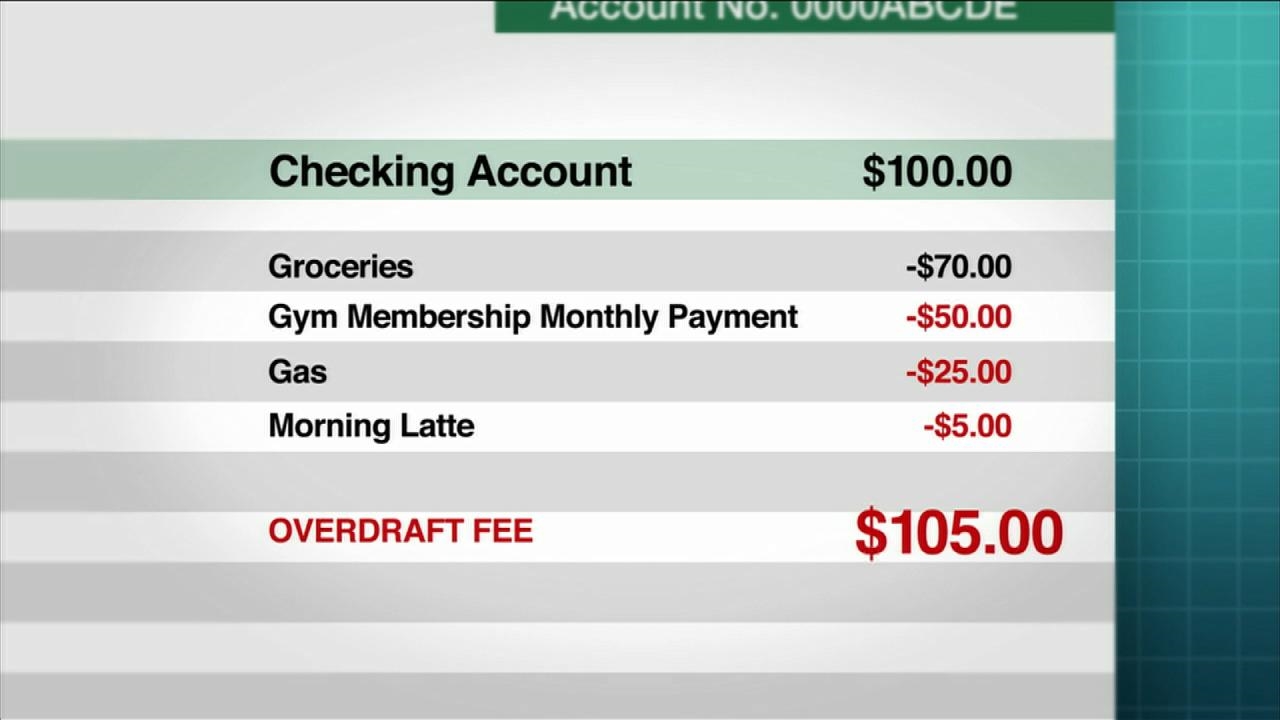

Overdraft fees can be a frustrating and costly experience for many bank customers, especially in a bustling city like New York. These fees occur when you spend more money than you have in your checking account, and the bank covers the difference, charging you a fee for the service. In NYC, where the cost of living is high, avoiding these fees can help you manage your finances more effectively. Here’s how you can avoid overdraft fees in NYC banks.

Monitor Your Account Regularly

One of the simplest ways to avoid overdraft fees is to keep a close eye on your account balance. With the convenience of online and mobile banking, you can easily check your balance anytime, anywhere. Set up alerts with your bank to notify you when your balance falls below a certain threshold. This proactive approach allows you to make informed decisions about your spending and avoid transactions that could lead to an overdraft.

Additionally, consider using budgeting apps that link to your bank account. These apps can help you track your spending habits and provide insights into where you might be overspending. By understanding your spending patterns, you can make adjustments to ensure you always have enough funds in your account to cover your expenses.

Opt-Out of Overdraft Protection

Many banks offer overdraft protection services, which automatically cover transactions that exceed your account balance. While this might seem convenient, it often comes with hefty fees. In NYC, where every dollar counts, opting out of overdraft protection can save you money in the long run.

When you opt-out, transactions that would cause an overdraft are simply declined, preventing you from incurring fees. Contact your bank to understand their specific policies and to opt-out if you haven’t already. Keep in mind that while this might mean some transactions are declined, it’s a small inconvenience compared to the potential cost of repeated overdraft fees.

Maintain a Financial Cushion

Another effective strategy to avoid overdraft fees is to maintain a financial cushion in your checking account. This means keeping a buffer of extra money in your account that you don’t touch unless absolutely necessary. Even a small cushion of $100 or $200 can prevent overdrafts from occurring.

To build this cushion, consider setting up automatic transfers from your savings account to your checking account. You can schedule these transfers to occur on a regular basis, such as monthly or bi-weekly, to gradually build up your buffer. This approach not only helps you avoid overdraft fees but also encourages better financial habits by ensuring you always have a safety net in place.