Understanding Credit Card Exchange Rates in Toronto

When traveling or making purchases in Toronto with a credit card, understanding how exchange rates work can save you money and help you make informed financial decisions. This guide will provide practical insights into how credit card exchange rates function, what factors influence them, and how you can manage your expenses effectively while in Toronto.

How Credit Card Exchange Rates Work

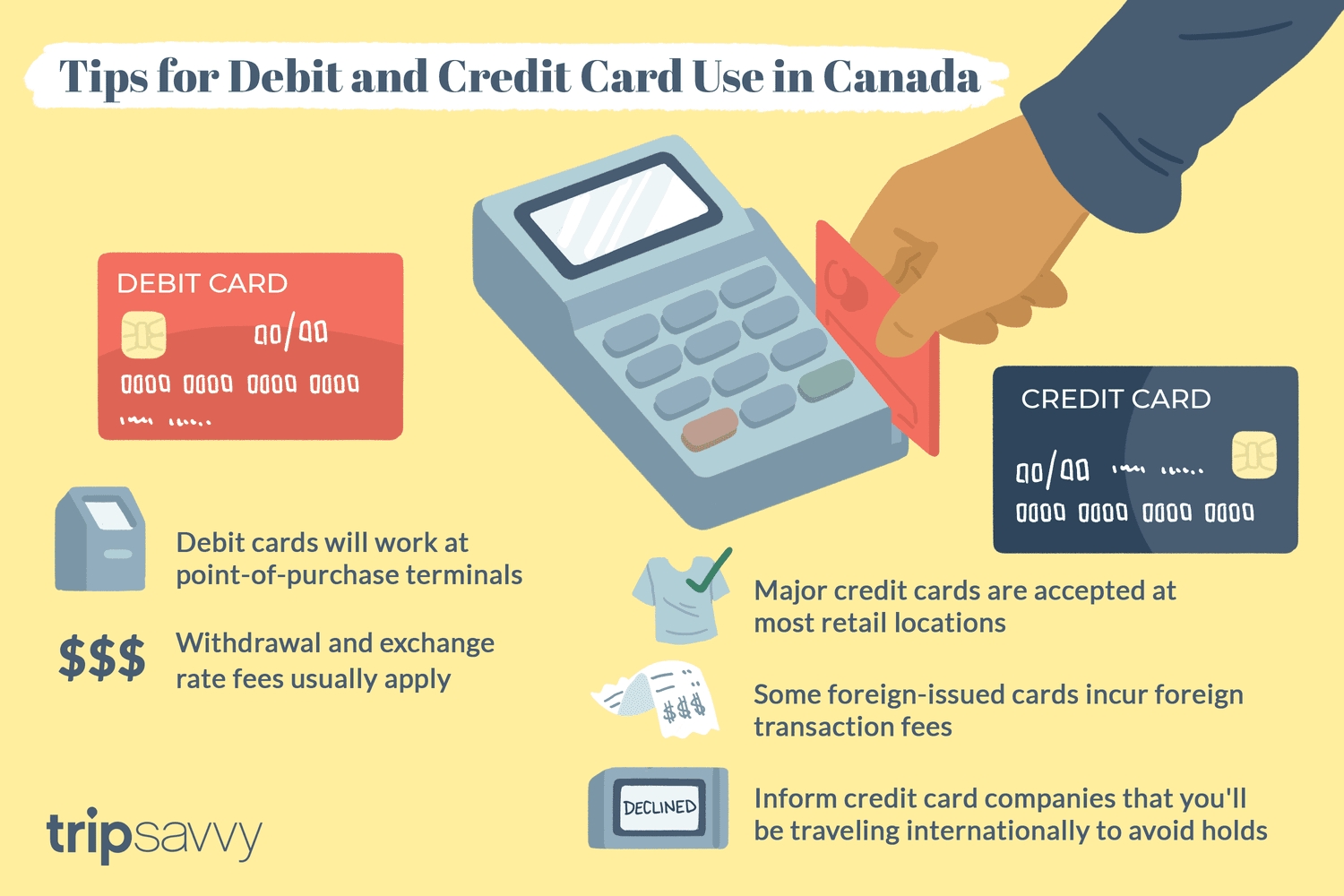

Credit card exchange rates are the rates at which your card issuer converts foreign currency transactions into your home currency. When you use your credit card in Toronto, the amount you spend in Canadian dollars is converted to your home currency using the exchange rate set by your card issuer. This rate is typically based on the interbank exchange rate, which is the rate banks use to trade currencies among themselves. However, card issuers often add a foreign transaction fee, which can range from 1% to 3% of the transaction amount, to cover the cost of currency conversion.

To find out the exact rate your card issuer uses, you can check your credit card statement or contact your card issuer directly. Some credit card companies also provide online tools or mobile apps that allow you to track exchange rates in real-time.

Factors Influencing Exchange Rates

Several factors can influence the exchange rates applied to your credit card transactions in Toronto. These include:

- Market Fluctuations: Exchange rates fluctuate constantly due to changes in the global currency markets. Factors such as economic data releases, geopolitical events, and changes in interest rates can all impact exchange rates.

- Card Issuer Policies: Different credit card issuers may have different policies regarding exchange rates. Some issuers might offer more competitive rates than others, so it’s worth comparing the rates offered by different cards before you travel.

- Foreign Transaction Fees: As mentioned earlier, many credit card issuers charge a foreign transaction fee. This fee can significantly affect the overall cost of your purchases, so it’s important to be aware of it when using your card abroad.

Tips for Managing Credit Card Expenses in Toronto

To make the most of your credit card while in Toronto, consider the following tips:

- Choose a Card with No Foreign Transaction Fees: Some credit cards are specifically designed for international travel and do not charge foreign transaction fees. Using such a card can save you money on every purchase you make in Toronto.

- Monitor Exchange Rates: Keep an eye on exchange rate trends before and during your trip. If the exchange rate is favorable, you might consider making larger purchases or paying for services in advance.

- Use Local Currency: When given the option, always choose to pay in the local currency (Canadian dollars) rather than your home currency. This avoids dynamic currency conversion, which often comes with unfavorable exchange rates and additional fees.

- Check Your Statements: Regularly review your credit card statements to ensure that the exchange rates and fees applied to your transactions are accurate. If you notice any discrepancies, contact your card issuer immediately.

By understanding how credit card exchange rates work and taking steps to manage your expenses, you can enjoy your time in Toronto without worrying about unexpected costs. Whether you’re dining out, shopping, or exploring the city, being informed about exchange rates will help you make the most of your financial resources.